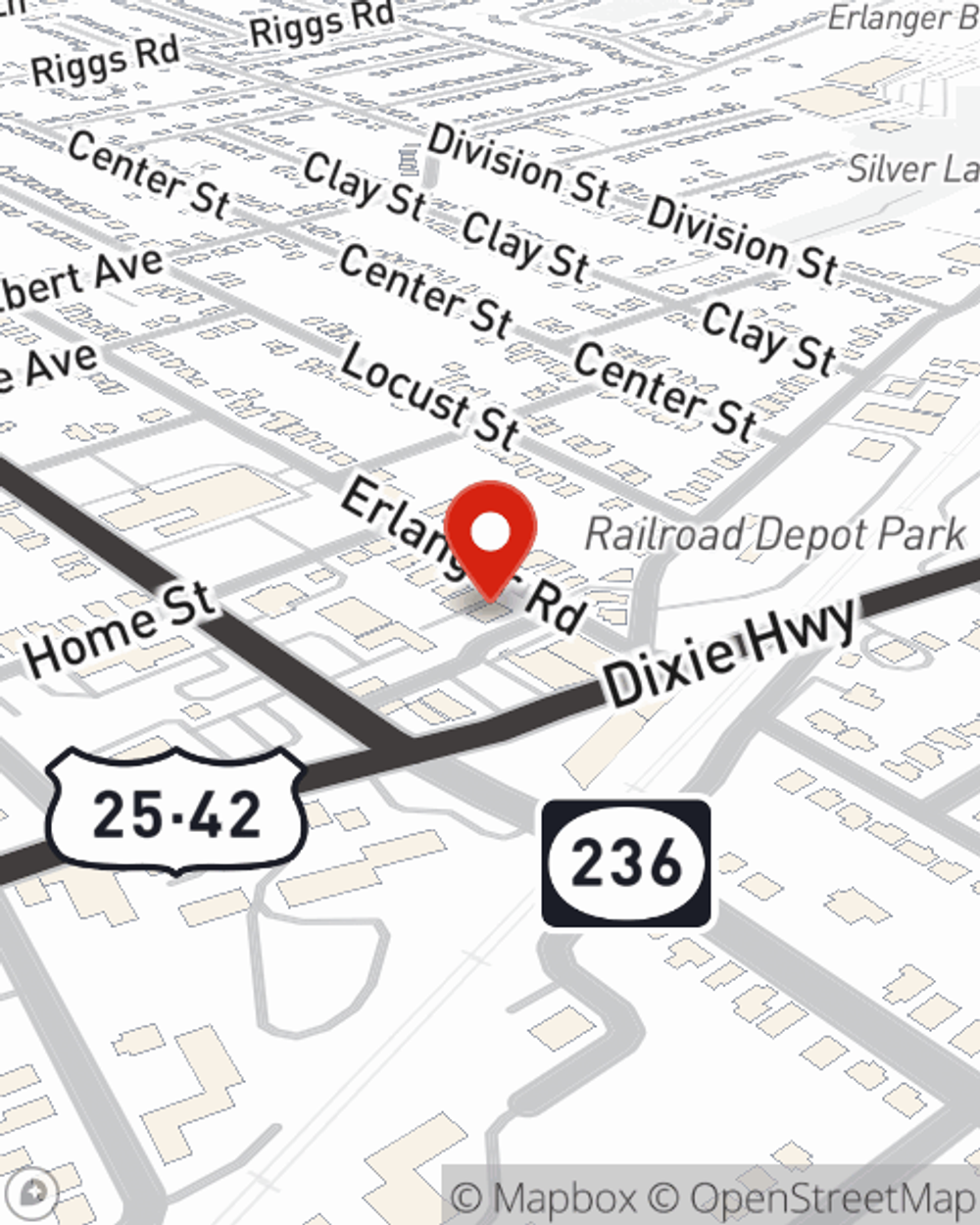

Business Insurance in and around Erlanger

Get your Erlanger business covered, right here!

Cover all the bases for your small business

- Erlanger, KY

- Covington, KY

- Independence, KY

- Taylor Mill, KY

- Fort Mitchell, KY

- Elsmere, KY

- Fort Wright, KY

- Ludlow, KY

- Crescent Springs, KY

- Edgewood, KY

- Villa Hills, KY

- Hebron, KY

- Boone County, KY

- Florence, KY

- Union, KY

- Kenton County, KY

- Campbell County, KY

- Newport, KY

- Alexandria, KY

- Walton, KY

- Crestview Hills, KY

- Park Hills, KY

- Lakeside Park, KY

- Hamilton County, OH

Your Search For Fantastic Small Business Insurance Ends Now.

Do you own a real estate appraisal business, a photography business or a domestic cleaning service company? You're in the right place! Finding the right coverage for you shouldn't be risky business so you can focus on your next steps.

Get your Erlanger business covered, right here!

Cover all the bases for your small business

Cover Your Business Assets

When one is as passionate about their small business as you are, it makes sense to want to make sure everything has been thought of. That's why State Farm has coverage options for commercial liability umbrella policies, surety and fidelity bonds, artisan and service contractors, and more.

As a small business owner as well, agent Allison Hornback understands that there is a lot on your plate. Reach out to Allison Hornback today to talk over your options.

Simple Insights®

Answers about automatic fire sprinkler systems

Answers about automatic fire sprinkler systems

Commercial sprinkler systems are a key step in fire protection. If you have questions, get answers to help protect your business from devastating fire damage.

Tips to help prevent water leakage at your business or home

Tips to help prevent water leakage at your business or home

Help prevent water damage in the workplace and at home by checking on appliances and installing leak detection systems.

Allison Hornback

State Farm® Insurance AgentSimple Insights®

Answers about automatic fire sprinkler systems

Answers about automatic fire sprinkler systems

Commercial sprinkler systems are a key step in fire protection. If you have questions, get answers to help protect your business from devastating fire damage.

Tips to help prevent water leakage at your business or home

Tips to help prevent water leakage at your business or home

Help prevent water damage in the workplace and at home by checking on appliances and installing leak detection systems.